Best Yield Farming Crypto Platforms in 2023

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Yield farming offers a way for investors to generate passive income on idle crypto tokens. In most cases, the tokens will be sent to a decentralized exchange for the purpose of providing traders with sufficient levels of liquidity.

In turn, those lending the tokens will earn a share of any trading fees collected by the exchange. In this comparison guide, we rank and review the 10 best yield farming crypto platforms for safety, yields, supported pairs, user-friendliness, and more.

The 10 Best Crypto Yield Farming Platforms List

A list of the 10 best yield farming crypto platforms in the market right now can be found below:

- Lucky Block - Overall Best Yield Farming Crypto Platform Alternative

- OKX - Top Yield Farming Crypto Platform with High Yields

- Battle infinity - Great Alternative to Yield Farming via Decentralized Staking

- eToro - Generate Passive Income on Ethereum, Cardano, and Tron

- Crypto.com - High-Yield Income Accounts Through Crypto Lending

- BlockFi - Competitive Interest Rates on Small Crypto Deposits

- Coinbase - Regulated Broker Offering Flexible Staking Pools

- Uniswap - Decentralized Exchange to Earn Yields on ETH-Based Tokens

- PancakeSwap - Popular Yield Farming Platform for BNB-Based Tokens

- YouHodler - Crypto Lending Ecosystem With Interest Accounts

While some of the providers listed above do not specialize in yield farming per se, they do offer some notable alternatives for passive income seekers.

As such, by reading our comprehensive platform reviews, investors can determine the best interest-bearing product for their requirements.

Reviewing the Biggest Yield Farming Crypto Platforms

The process of selecting the best yield farming crypto platform requires investors to explore a range of factors.

In addition to the safety and reputation of the platform, other important metrics include available yields, supported coins, and the frequency of reward distribution.

Below, we rank and review the 10 providers from the above yield farming crypto list.

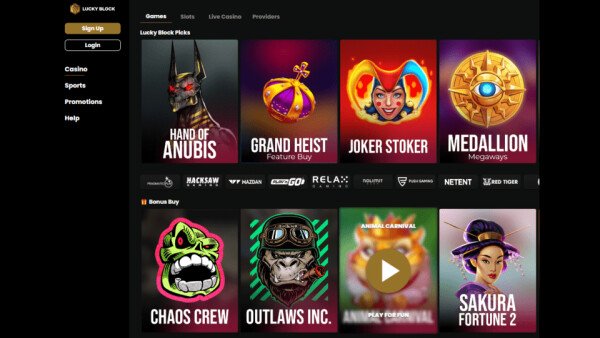

1. Lucky Block - Overall Best Yield Farming Crypto Platform Alternative

Those seeking the best yield farming crypto platform this year may wish to consider Lucky Block. It's important to note that Lucky Block isn't technically a yield farming platform, yet it offers a viable alternative that can compete (and beat) the returns these platforms provide.

As noted in our Lucky Block review, this platform boasts over 2,700 games from top providers, including NetEnt and Pragmatic Play. Users can fund their accounts with ten different cryptos, such as BTC and ETH, and then begin playing these games with a deposit of just $1.

By taking this approach, users have the chance to win crypto through gambling on classic casino games or sports. Although this isn’t the same as traditional yield farming, the returns can often be much more appealing for those with a higher tolerance for risk.

Aside from the betting aspect, Lucky Block offers several promotions that can mirror what yield staking platforms provide. These include a 15% cashback promotion for each user's first seven days on the platform. Cashback is paid out on net losses and can be claimed by contacting the customer support team on day eight.

In addition, Lucky Block has just launched a new ‘Races’ feature, which rewards active players. Players can receive up to €1,000 in rewards by playing their favourite games – with no minimums needing to be met. Prizes are distributed based on the player's turnover within the allotted period and act as a viable alternative to traditional yields.

Finally, as one of the best Bitcoin casinos, Lucky Block has gained traction from crypto investors in the wake of the FTX disaster. The contagion effect from this disaster has caused liquidity issues throughout the industry – leading many top staking platforms to suspend customer withdrawals.

This isn’t a worry with Lucky Block, which is why it has emerged as an alternative to these platforms. Users can sign-up for a Lucky Block account in minutes, with no KYC checks – although UK and US investors will require a VPN to access the site.

| Yield Services | Alternative to yield farming platforms - offers crypto games, cashback, 'Races', and more |

| Coins Supported | Ten different cryptos, including BTC, ETH, DOGE, and LTC |

| Rates | N/A - returns are based on luck and skill |

Pros:

- The best alternative to traditional yield farming crypto platforms

- Offers 15% cashback for the first seven days

- Over 2,700 games to play from top providers

- Supports deposits in ten different cryptos

- The minimum deposit is just $1 (or crypto equivalent)

- The new 'Races' feature offers high reward potential

Cons:

- UK and US players must use a VPN to access the platform

2. OKX - Top Yield Farming Crypto Platform with High Yields

Another top pick for the best yield farming crypto platform is OKX. Although primarily known for its low-cost spot trading exchange, OKX offers an entire crypto ecosystem. Not only does this include staking and interest accounts, but a fully-fledged yield farming department.

In partnership with SushiSwap, OKX offers a variety of yield farming pairs - each of which contains Ethereum. This includes Sushi, tether, Dai, USD Coin, and Wrapped Bitcoin. Although yields will vary as per any other yield farming platform, OKX states that the average APY on SUSHI/ETH and USDT/ETH is 6.52% and 5.78%, respectively.

Estimated yields on DAI/ETH and USDC/ETH amount to 4.81% and 4.31% respectively, and just 0.55% on WBTC/ETH. Crucially, however, all yield farming pools hosted by OKX are offered on a flexible basis. And in turn, this means that there is no lock-up period. Investors can therefore withdraw their tokens from the yield farming pool at any given time.

In addition to yield farming, investors might also consider the staking feature at OKX. This also offers the opportunity to generate passive income on idle crypto tokens, but the process does not require investors to provide liquidity for a trading pair. Instead, just one token is required for each staking agreement.

In this regard, OKX supports dozens of coins for the purpose of staking across both flexible and fixed terms. Yields will vary depending on the chosen coin and term. For example, On a 90-day term, Shiba Inu staking yields an APY of 12%. Over the same timeframe, Decentraland yields 5%.

Supported coins that carry a smaller market capitalization will typically generate a much higher yield. For example, the APY on a 120-day term across Glimmer and Kusama yields an estimated APY of 70.75% and 34.32%, respectively. OKX also offers fixed-income accounts, which will appeal to investors that wish to know exactly how much interest will be generated on their capital.

Bitcoin and Ethereum both yield a fixed-income rate of 2% across a 180-day term. All in all, not only is OKX the overall best yield farming crypto platform in the market, but it offers plenty of other DeFi products and services for maximum flexibility.

All in all, OKX is a great yield farming platform that allows users to make money with cryptocurrency in 2023.

| Yield Services | Yield farming, staking, interest accounts |

| Coins Supported | Multiple blockchains including ETH, BTC, SOL |

| Rates | Up to 6.52% APY on yield farming |

Pros

- Overall best yield farming crypto platform

- Supports yield farming, staking, and interest accounts

- Competitive APYs

- Flexible yield farming pools

- Multiple blockchain networks supported

- Access the best altcoins across 600+markets

- Great reputation in the crypto space

Cons

- Only ETH-based coins are supported when yield farming

Crypto assets are highly volatile investment products. Your capital is at risk.

3. Battle infinity - Great Alternative to Yield Farming via Decentralized Staking

As we briefly noted above, staking is a great alternative to yield farming. In fact, there are many benefits of choosing to opt for staking for the purpose of earning free crypto. First and foremost, the best crypto staking platforms offer fixed APYs. This means that investors know exactly how much they will earn on the staked tokens.

In comparison, it is impossible to estimate yield farming rewards, as this will depend on the correlation and market value of the two cryptocurrencies that form the respective pair. Another benefit of opting for staking is that investors only need to deposit one crypto asset. As noted, yield farming requires investors to deposit an equal amount of two different staking coins.

One of the best options to consider in the staking scene is Battle Infinity. This project is building a metaverse ecosystem that will host multiplayer games - each of which utilizes the play-to-earn concept alongside NFT ownership. By playing Battle Infinity games, users will earn the project's native token - IBAT.

IBAT recently completed its crypto presale campaign, whereby the project raised the equivalent of $5 million in just 24 days. Back to staking, the Battle Infinity platform now enables IBAT holders to generate a passive income on their tokens. Flexible staking rewards are offered at an APY of 12%. Higher rates are available when opting for a fixed term.

The easiest way to stake IBAT is to first buy Battle Infinity tokens from PancakewSwap or LBank. Then, it's just a case of transferring the IBAT tokens to a private wallet, which can then be connected to the Battle Infinity staking tool.

| Yield Services | Flexible and fixed staking |

| Coins Supported | IBAT |

| Rates | 12% APY on flexible staking, higher yields on fixed-terms |

Pros

- One of the best crypto ICOs of 2022

- Earn passive income on a top trending crypto

- Stake IBAT on flexible withdrawal terms

- Highest yields offered on fixed-terms

- No requirement to register or provide any personal information

Cons

- Only supports IBAT staking at this moment in time

Crypto assets are highly volatile investment products. Your capital is at risk.

4. eToro - Generate Passive Income on Ethereum, Cardano, and Tron

eToro is a regulated crypto exchange and broker that also supports stocks, ETFs, commodities, indices, and commodities. This provider is considered a safe and legitimate crypto trading platform, not least because it is licensed by the SEC, ASIC, FCA, and CySEC. eToro is used by more than 27 million traders from around the world.

Although eToro does not offer yield farming, the platform does enable clients to generate passive income through staking. At this moment in time, three proof-of-stake coins are supported - Ethereum, Cardano, and Tron. In addition to offering a regulated platform to earn interest, eToro represents a good option because it does not require investors to opt into the staking tool.

On the contrary, investors will begin earning staking rewards after the minimum holding period has passed. For example, after buying Tron on eToro, the generation of staking rewards will begin on the eighth day of holding. There are no lock-up periods when staking coins on eToro and investors have the freedom to cash out 24 hours per day, 7 days per week.

In terms of yields, the profit-sharing agreement will depend on the reward status of the eToro user. For example, bronze members - in addition to all US-based users, will receive 75% of any staking rewards generated by eToro. Diamond and club members, however, will receive 90%. From start to finish, it takes just 5-10 minutes to begin staking crypto on eToro.

After opening an account, USD deposits with a debit/credit card or e-wallet will be processed instantly and fee-free. Investors can then buy a supported staking coin from just $10.

| Yield Services | Flexible staking |

| Coins Supported | Ethereum, Cardano, Tron |

| Rates | Up to 90% of staking rewards generated by eToro |

Pros

- Regulated crypto platform with more than 27 million clients

- Stake Ethereum, Cardano, and Tron without needing to opt-in

- Access dozens of the best crypto to buy from just $10

- No fees on USD deposits

- Passively trade crypto through Copy Trading

Cons

- Just three staking coins are supported - but more will be added soon

Crypto assets are highly volatile investment products. Your capital is at risk.

5. Crypto.com - High-Yield Income Accounts Through Crypto Lending

In a similar nature to OKX, Crypto.com is primarily known for its crypto exchange platform. This provider offers access to more than 250 markets - which includes a wide selection of the best meme coins to buy. Moreover, Crypto.com offers even cheaper commissions than Binance, with the highest rate charged at just 0.075% per slide.

In addition to its exchange platform, Crypto.com also enables investors to earn passive income. While this doesn't come in the form of yield farming, Crypto.com offers interest accounts on dozens of coins. Each and every supported coin comes with three lock-up options. This includes one and three-month terms, as well as flexible withdrawals.

The longer the term, the higher the APY. Moreover, to maximize the yields on offer, Crypto.com interest account earnings can be boosted by staking Cronos (CRO). This token is native to the Crypto.com ecosystem and holders will also be offered lower trading commissions. On stablecoins, the best yield offered by Crypto.com is 8.5%.

On standard crypto assets, the highest yield is 14.5%. Crypto.com offers a variety of other DeFi services on its platform, which includes a custodial wallet app for iOS and Android. The platform also offers crypto-backed loans with a maximum LTV of 50%. There is also a Crypto.com pre-paid debit card, which can be used online, in-store, and at ATMs.

| Yield Services | Flexible, 1-month, and 3-month interest accounts |

| Coins Supported | Dozens of crypto assets and stablecoins |

| Rates | Up to 14.5% on crypto assets and 8.5% on stablecoins |

Pros

- Earn up to 14.5% on some of the best long-term crypto assets

- High yield farming crypto rates on stablecoins

- Choose from flexible, 1-month, or 3-month terms

- Interest rewards are paid weekly

- Spot trading commissions are just 0.075%

Cons

- Investors are required to stake CRO to obtain the highest APY

6. BlockFi - Competitive Interest Rates on Small Crypto Deposits

BlockFi is another alternative to consider on this list of the best yield farming crypto platforms. This provider specializes in crypto lending across both ends of the transaction. This means that investors can deposit their tokens into BlockFi to generate interest on lending agreements. Borrowers can also use BlockFi to obtain instantly approved crypto loans.

With that being said, BlockFi is perhaps more suited to those that wish to earn interest on a small allocation of crypto tokens. The reason for this is that the larger the deposit, the less competitive the interest rate structure becomes. For example, those depositing up to 0.1 Bitcoin into BlockFi will earn a competitive APY of 3.50%.

However, anything above 0.1 Bitcoin will only be paid at 2%. In the case of Ethereum, the first 1.5 ETH deposited will yield 3.5%, while anything above this drops to the 2% level. At BlockFi, the highest interest rewards are actually paid on stablecoins. Across USD Coin, Binance Coin, PAX, and Gemini Coin, an APY of up to 7.50% can be earned.

Moreover, limits are much higher, with the top-tier rate being paid on balances of up to $20,000. Another benefit of choosing BlockFi is that all of its interest accounts offer flexible withdrawals.

| Yield Services | Flexible interest accounts |

| Coins Supported | BTC, ETH, DOGE, LTC, UNI, LINK, ALGO, BCH, BAT, PAXG, USDC, BUSD, DAI, PAX, GUSD |

| Rates | Up to 3.5% on crypto assets and 7.5% on stablecoins |

Pros

- Earn up to 7.5% on stablecoin interest accounts

- Flexible withdrawals without any penalties

Cons

- Small limits on the highest rates offered

- APYs seem to change at a moment's notice

7. Coinbase - Regulated Broker Offering Flexible Staking Pools

Coinbase is one of the most popular crypto exchanges globally. This user-friendly platform supports more than 100 crypto assets - most of which can be purchased instantly with a Visa or MasterCard. With that said, Coinbase fees are high, with debit/credit card payments attracting a charge of almost 4%.

Moreover, trading crypto assets on the Coinbase exchange will attract fees of 1.49% per slide. Coinbase does not offer yield farming services, but it does support staking. This includes support for six different coins, with Algorand offering the highest yield at 5.75%.

Cosmos and Tezos are the next highest-yielding coins supported, with an APY of 5% and 4.635% respectively. Coinbase staking is available in more than 70 countries and withdrawals are flexible. The minimum amount that can be earned when staking crypto at Coinbase is $1.

| Yield Services | Flexible interest accounts |

| Coins Supported | ALGO, ADA, ATOM, ETH, SOL, XTZ |

| Rates | Up to 5.75% |

Pros

- Top staking platform for beginners

- Heavily regulated

Cons

- Better staking yields are available elsewhere

- Is not transparent on staking fees

- High trading commissions and deposit fees

8. Uniswap - Decentralized Exchange to Earn Yields on ETH-Based Tokens

Uniswap is a decentralized exchange that is built on top of the Ethereum blockchain. By using Uniswap to trade, there is no requirement to go through a third party. Moreover, Uniswap users simply need to connect their wallet to the exchange - meaning no account registrations, personal information, or KYC documents.

As such, Uniswap is the best yield farming crypto platform for those looking to earn passive income in an anonymous manner. Uniswap specializes in Ethereum-based yield farming pairs. Some of the most popular liquidity pools on Uniswap include DAI/USD, USDC/ETH, and WBTC/ETH.

Yields will vary widely depending on the chosen liquidity pool and estimated APYs are not displayed by Uniswap. Nonetheless, as yield farming on Uniswap is decentralized, the exchange does not have access to the tokens. On the contrary, the Uniswap ecosystem is facilitated by Ethereum-backed smart contracts.

| Yield Services | Yield farming on ETH-backed tokens |

| Coins Supported | Any ERC-20 token |

| Rates | Varies depending on market conditions and the respective pair |

Pros

- Decentralized exchange offering ETH-based yield farming services

- No requirement to open an account

Cons

- Does not offer estimated APYs on yield farming

- Not suitable for beginners

- Only supports ETH tokens

9. PancakeSwap - Popular Yield Farming Platform for BNB-Based Tokens

While Uniswap dominates the decentralized exchange space for tokens operating on the Ethereum blockchain, PancakeSwap specializes in coins that follow the Binance Smart Chain (BSc) standard. In fact, PancakeSwap often hosts the fastest growing cryptocurrencies in the market - with examples including Battle Infinity and Lucky Block.

Just like Uniswap, PancakewSwap offers a fully-fledged yield farming ecosystem that operates in a decentralized manner. This provider is, perhaps, the best yield farming crypto platform for high yields. For example, yield farming pools on CAKE/BNB and CAKE/USDT are offering an estimated APY of nearly 50%.

Even solid pairs like BUSD/BNB offer up to 11.6%, which is competitive. To access yield farming pools on PancakeSwap, users simply need to connect a compatible wallet - such as MetaMask or Trust Wallet.

| Yield Services | Yield farming on BSc-backed tokens |

| Coins Supported | Any BSc token |

| Rates | Up to 294% APR ad of writing |

Pros

- Best yield farming crypto platform for BSc tokens

- No account registrations - generate passive income anonymously

Cons

- Many yield farming pools are overly volatile

- Only supports BSc tokens

10. YouHodler - Crypto Lending Ecosystem With Interest Accounts

YouHodler is a direct competitor to BlockFi, not least because the platform specializes in crypto lending services. As such, YouHodler does not host yield farming pools. It does, however, enable investors to deposit tokens for the purpose of funding third-party loans. At this moment in this, YouHodler is a popular option for those looking to earn interest on stablecoins.

The likes of USDT, DAI, USDC, TUSD, and BUSD each yield 8% annually. There are dozens of other crypto assets supported on YouHolder, with Bitcoin and Ethereum offering an APY of 3% and 4% respectively. The highest yield on offer as of writing is the 10% paid on Polkadot.

| Yield Services | Interest accounts on 1, 3, and 12-month terms |

| Coins Supported | Dozens of crypto assets and stablecoins |

| Rates | Up to 10% on crypto assets and 8% on stablecoins |

Pros

- Generate an APY of up to 8% on stablecoins

- Interest payments compound weekly

Cons

- Does not offer flexible terms

- 12-month Bitcoin plans yield just 3%

What is Crypto Yield Farming? Crypto Yield Farming Explained

In a nutshell, crypto yield farming is a decentralized finance product that enables investors to earn passive income on idle tokens. In most cases, investors will lend tokens to a decentralized exchange, which enables the provider to offer liquidity pools to traders.

This means that traders can utilize the decentralized exchange to swap tokens without needing to open an account or upload any KYC documents. Those lending tokens to the exchange will have the opportunity to earn interest.

However, unlike crypto staking, yield farming deals in trading pairs. This means that the investor will need to have access to an equal quantity of tokens for the pair they wish to provide liquidity for. This is based on the monetary value at the time of the transaction, not the number of tokens.

- For example, let's say the investor wishes to provide liquidity for the BNB/BUSD pair - which consists of BNB and Binance USD.

- We'll say that BNB is trading at $300.

- As a result, if the investor wishes to provide 3 BNB ($900) to the yield farming pool, they also need 900 BUSD tokens ($900).

We offer a more detailed explanation of how yield farming works shortly.

How Does Crypto Yield Farming Work?

In this section of our beginner's guide, we cover the fundamentals of yield farming in much more detail.

Liquidity Pools

Decentralized exchanges require sufficient levels of liquidity to offer a functional trading ecosystem. Rather than using centralized order books, decentralized exchanges utilize an automated marker maker (AMM) model.

In simple terms, this enables traders to swap one crypto token for another without needing to have a seller at the other end of the trade. The tokens are subsequently swapped within the respective liquidity pool via smart contract agreements.

Trading Pairs

Yield farming requires investors to provide liquidity for a trading pair - meaning two different tokens are required.

As noted above, the investment must be on the basis of an equal amount of both crypto assets, in monetary terms not the number of tokens.

This will be determined at the time of the deposit based on current exchange rates.

Although this might sound cumbersome, many of the yield farming platforms discussed today also offer exchange services. This means that investors can swap the tokens they require for their desired yield farming pool.

Yields

One of the key issues with yield farming is that it is impossible to know what yields the chosen liquidity pool will generate. The reason for this is that it depends on the broader market conditions of the two tokens that represent the pair.

This is why yield farming is considered riskier than staking from an investment perspective. After all, many staking pools offer a fixed rate of interest, so returns are predictable.

Smart Contracts

Yield farming pools are often hosted by decentralized exchanges.

This means that after connecting a wallet to the exchange and confirming the yield farming agreement, the transaction is then handled by a smart contract.

This is beneficial to the investor, as it means that the chosen yield farming platform does not have access to the tokens.

Once the investor decides that they wish to pull their crypto out of the liquidity pool, the smart contract will automatically transfer the tokens back to the connected wallet.

Is Yield Farming Crypto Worth it?

In most cases, yield farming crypto platforms are more suitable for investors with a higher risk appetite.

Not only is this because of the unpredictable nature of yields, but there is also the risk of impairment loss.

This means that the APY being offered on the yield farming pool is less favorable than had the investor simply left the tokens in a private wallet.

With that said, yield farming has been known to generate some highly favorable returns that far outweigh what is available when opting for staking or a crypto interest account.

Investors will, however, be required to take on additional risk to target the high returns on offer.

What Cryptocurrencies Can You Yield Farm?

In theory, there is no limit to the number of cryptocurrencies that can be used when engaging in yield farming. After all, decentralized exchanges enable users to set up their own liquidity pool of any trading pair - as long as the underlying network supports it.

Nonetheless, in this section, we discuss five cryptocurrencies that are popular with yield farming platforms.

OKB Token

OKB is the native crypto asset of the OKX exchange. As of writing, this digital currency carries a market capitalization of just under $1 billion.

OKB is best staked on the OKX exchange, with the platform offering a yield of 1% on flexible withdrawals. Fixed-income accounts come with a higher interest rate of up to 2%.

IBAT

IBAT is the native digital asset of the Battle Infinity ecosystem. This project recently completed its presale phase, raising over $5 million in just 24 days.

IBAT can be staked on the Battle Infinity platform in a decentralized manner. It's just a case of connecting a supported wallet to the dashboard and choosing from a fixed or flexible term.

The former offers flexible withdrawals at an APY of 12%.

Tether

If the primary focus is on earning interest, then Tether is worth considering. The reason for this is that Tether is pegged to the US dollar.

As such, barring an unlikely de-pegging, Tether enables investors to earn income without the volatility typically associated with crypto assets.

On the OKX exchange, Tether can be deposited into a savings account at a yield of 10%.

Bitcoin

Bitcoin is trading 70% below its prior all-time high of over $68,000. As such, buying Bitcoin at current pricing levels offers an attractive upside.

With that said, it is also possible to earn interest on Bitcoin via an OKX savings account. As of writing, this is yielding an attractive APY of 5%.

SUSHI/ETH

Those looking to engage specifically in yield farming might consider the trading pair SUSHI/ETH. By farming this pair on the OKX exchange, investors can earn an estimated yield of 5.70%.

This is offered on a flexible term, so withdrawals can be made at any time.

Is Crypto Yield Farming Taxed?

In many jurisdictions, the likes of yield farming, staking, and interest accounts are taxed in the same way as income.

This means that the proceeds (e.g. interest payments) will count towards the investor's annualized income, in addition to a salary.

Moreover, the value of the proceeds is often based on the price of the tokens on the date they are received.

Naturally, this can make the accounting process complex, considering that the best yield farming crypto platforms make distributions weekly.

However, no two jurisdictions are the same when it comes to taxation on crypto in general. As such investors should consult with a tax specialist in their country of residence.

Is Crypto Yield Farming Safe?

All investment products within the crypto space carry an inherent level of risk. In the case of yield farming crypto, there are several core risks to take into account.

At the forefront of this is the implication of impairment loss. As noted earlier, this will occur when there is a valuation imbalance in the respective liquidity pool.

In turn, the investor would have made more favorable gains had they kept the tokens in a private wallet, as opposed to a yield farming pool.

Investors should also consider the risk associated with the chosen platform.

For instance, if there is a bug in the smart contract that backs the platform and this is exploited by a hacker, then the tokens held in the yield farming pool could be stolen.

Investors should also consider the volatility risk. After all, if the value of both tokens being held in the liquidity pool declines, then this will result in a financial loss.

Conclusion

This beginner's guide has reviewed the best yield farming crypto platforms in the market right now.

We have also explored the benefits and risks of yield farming, in addition to any tax implications that should be considered.

Those wishing to proceed with a yield farming investment today might consider Lucky Block. More people than ever are using Lucky Block as a yield farming alternative, due to the ongoing volatility in the space.

With high returns potential and exciting promotions, which include 15% cashback for each user's first seven days, Lucky Block is a great option for those seeking something different to yield farming.

FAQs

Is crypto yield farming profitable?

In many instances, crypto yield farming can be extremely profitable. However, this isn't always the case. Crucially, yield farming is a lot riskier than other DeFi products, such as staking, not least because of the impact of impairment loss. Moreover, APYs on yield farming pools are both volatile and unpredictable. Nonetheless, some investors have made sizable gains when yield farming.

What is the best platform for crypto yield farming?

Lucky Block is perhaps the best yield farming crypto platform in the space right now. Although not technically a yield farming platform, Lucky Block offers similar (or better) yield potential - all without the risk of the platform becoming insolvent.

Which crypto can you yield farm?

In theory, there are no limitations when it comes to supported yield farming coins. This is especially the case when using a decentralized exchange, as users have the capacity to add liquidity pools. With that said, small-cap tokens that have little exposure will rarely attract any liquidity, which makes the yield farming process very risky.

Does Coinbase allow yield farming?

No, Coinbase does not support yield farming. The exchange does, however, enable investors in over 70 countries to stake their idle tokens. This is supported across six different tokens and the highest APY offered is 5.75%. Having said that, DeFi Yield allows eligible Coinbase traders to earn yield by lending their crypto holdings out to third-party DeFi protocols. At the moment, clients can earn yield on several digital assets such as Dai and USDT. The proposed APY varies depending on the rates set by Compound Finance (a popular DeFi protocol) and current crypto market conditions.