The Difference Between ICO and STO

On the surface, both initial coin offerings and security token offerings follow a similar process where an investor gets a crypto coin or token which represents their investment. But unlike an ICO coin or token, a security token comes with an...

On the surface, both initial coin offerings and security token offerings follow a similar process where an investor gets a crypto coin or token which represents their investment. But unlike an ICO coin or token, a security token comes with an underlying investment asset, like stocks, bonds, funds or real estate investment trusts (REIT).

However, there are more differences between ICO and STO. Let's take a look at them here.

How Is STO Different From ICO?

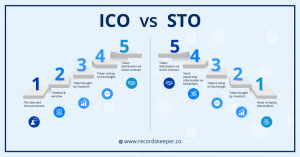

First and foremost, most ICOs are meant for raising funds in an unregulated environment.

Most ICOs actually position their offerings as utility tokens to circumvent regulations. Most founders and projects argue that they distribute users tokens to access their decentralized applications (DApps) or native platforms. The main logic here is that the purpose of their coin is usage and not speculation. Such line of reasoning lets ICO projects to avoid regulation and necessary registration with SEC or other strict regulators.

In contrast, STOs are launched with regulatory governance in mind. They are registered with required government bodies, meet all the legal requirements and are 100% lawful.

Hence, it is way easier to launch an ICO than STO. STO requires a company to do a lot of upfront compliance work. While everyone can launch and participate in an ICO (unless local laws state otherwise), only entirely regulatory compliant companies and accredited or at least known investors can sell and purchase security tokens.

ICO vs. STO — Advantages

The most commonly mentioned advantages of an ICO include:

- No entry barrier for both buyers and sellers.

- Positive network effects.

- The tokens are distributed in a simple automated way.

- The teams can manage their funds however they prefer.

- A successful ICO often requires just a well-executed digital campaign.

- If a coin raises in price and team delivers, investors enjoy high profitability and early adopter benefits.

- Some ICOs allow for anonymous participation.

At the same time, an STO offers the following advantages:

- Investors actually acquire underlying assets that derive their value from something else.

- 100% regulated offerings that ensure investors security.

- Projects that go for STOs are generally more mature and trustworthy than the ones in the ICO sphere.

- STOs are experiencing significant growth while ICOs space shrinks.

- It is an ongoing trend.

- Security tokens are expected to be traded via broker-dealers who are also supervised by regulatory bodies.

- Security tokens are the next big step in traditional finance.

- Less speculation and market manipulation.

ICO vs. STO — Disadvantages

The most obvious disadvantages of an ICO are:

- High volatility and manipulation of the crypto market.

- Low liquidity.

- Uncertainty if the product will be finished and delivered as stated in the white paper.

- Scams and pump and dump schemes are common for ICOs.

- Regulations can cause problems for both projects and investors.

- Unregulated space with a lot of risks.

Meanwhile, the disadvantages of STOs are:

- Takes a lot of time, effort, and money to get a green light from the regulators.

- Can be limited to accredited investors only.

- Can require significant amounts of money.

- So far, the SEC has not approved a single Reg A+ STO, and only allows for institutional investor participation.

Despite the differences, both ICO and STO are proven fundraising methods for blockchain and similar projects and both of them come with their pros and cons. You need to decide for yourself where you want to participate and what is your level of risk tolerance.