Bitcoin Prices and Ethereum Prediction; Could BTC and ETH Breakout for 5% Gains Before the Weekend?

Over the past few days, Bitcoin and Ethereum have been experiencing choppy trading, possibly due to the Chinese Lunar New Year, as Asian investors are out on holiday. With the current market conditions, many investors are wondering if BTC and ETH could break out for 5% gains before the weekend.

In this update, we will explore the factors that could lead to a breakout and make predictions as to whether or not it is likely to happen. We will also look at how these cryptocurrencies have been performing recently and what experts are saying about their future prospects.

Top Altcoin Gainers and Losers

Fantom (FTM), eCash (XEC), and Polygon (MATIC) were the top performers in the last 24 hours. FTM's price has increased by more than 13.50% to $0.46, while XEC's price is up by nearly 7% to $$0.000041. At the same time, MATIC has gained just under 10% to trade at $1.09.

Over the last 24 hours, Threshold (T) has dropped around 7.50%, to $0.055; however, it is still up nearly 150% in the last seven days. Optimism (OP) has decreased by over 10%, to around $2.15, and Lido DAO (LDO) has declined by about 8.85%, to $2.30.

Cryptocurrency Market Fundamentals – What You Need To Know Before Investing

The US GDP numbers exceeding expectations led to a brief rally in the cryptocurrency prices. However, this rally was short-lived due to the still tight labor market and speculation that the Federal Reserve may keep interest rates high for a longer duration.

Moving forward, the release of Personal Consumption Expenditures (PCE) data today, along with a slew of other data releases this week, is expected to create a highly volatile market environment, potentially leading to further losses in crypto assets like Bitcoin (BTC) and Ethereum (ETH).

US Data Soars; BTC and ETH Under Pressure

According to the US Commerce Department, consumer spending increased in the fourth quarter of last year, resulting in a higher-than-expected 2.9% annual growth rate of the gross domestic product.

In the meantime, the GDP price index decreased to 3.5%, and personal consumption expenditures growth slowed to 2.1% year-over-year from 2.3% in the prior quarter, improving the inflation data as well.

However, the Federal Reserve's significant interest rate increases from the previous year reduced demand and slowed growth toward the end of 2022, presenting difficult decisions for US central bank policymakers.

Notably, the Federal Reserve's overnight rate is expected to reach 4.45% by December, which is lower than the 5.1% rate Fed officials had predicted for the rest of the year due to market expectations of a rate cut. Futures are pricing a 94.7% probability of a 25 basis point hike next Wednesday.

Therefore, investors will be closely monitoring the upcoming Federal Reserve decision, which will have a considerable impact on the cryptocurrency market.

Ted Cruz Pushes For Bitcoin Payments To Be Accepted By Capitol Hill Vendors

On Wednesday, Senator Ted Cruz introduced a bill in the Senate that would allow cryptocurrency payments within the Capitol, signaling that Republicans remain interested in legislation governing digital assets.

However, the new directive applies to those in charge of running daily operations in the House of Representatives and Senate, and it encourages them to work with people who will accept digital assets as payment for goods and services.

If successful, this could be good news for the entire cryptocurrency market.

Elon Musk's U-Turn: Tesla Stopped Accepting Bitcoin

Tesla, a maker of electric vehicles, decided not to sell any additional Bitcoin (BTC) during the second half of 2022, despite having already sold 75% of its holdings during that quarter.

On January 25, Tesla released its Q4 results, which showed that the company had not bought or sold any of its Bitcoin holdings for the second consecutive quarter.

This was seen as an important factor that could help the crypto market regain its footing.

Bitcoin Price

Bitcoin is currently valued at $23,004, with a 24-hour trading volume of $26 billion. In the last 24 hours, Bitcoin has been choppy, down less than 1%. With a live market worth of $435 billion, CoinMarketCap currently ranks top.

Bitcoin is presently experiencing an obstacle at the $23,250 mark and its immediate support is holding steady at $22,500.

If the price of Bitcoin falls below $22,500, a bearish market trend is likely to occur and could go all the way down to around $21,500. If it continues to dip from there and reaches $20,450 then it's possible we could see an even more bearish trend.

Both the Relative Strength Index and Moving Average Convergence Divergence are in an overbought territory. Nevertheless, a bullish engulfing candle has been seen recently which could indicate that the bullish market trend will continue.

Positively, Bitcoin's immediate resistance level is at $23,250; if it breaks above this price point, it could potentially move as high as $23,900 and $25,150.

Ethereum Price

Ethereum is currently trading at $1,580 and has experienced a 2.50% decrease in the past 24 hours with a total trading volume of $8.7 billion. It's ranked 2nd on CoinMarketCap, with a live market capitalization of $193 billion.

The ETH/USD pair experienced a sharp downturn from the $1,600 level in the 4-hour timeframe. This drop was triggered by a violation of an upward channel and subsequent closing below this price point. The downward trend eventually led to a bottom at the $1,525 mark.

ETH could possibly experience resistance at $1,600. If it is able to cross this level, its price might get uplifted to $1,675. Alternatively, there is a possibility of a downward trend starting from $1,525, which could extend to $1,445 if it does breakdown.

Bitcoin Alternatives

CryptoNews Industry Talk has reviewed the top 15 cryptocurrencies for 2023. If you're looking for a higher potential investment opportunity, there are plenty of other projects worth considering.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

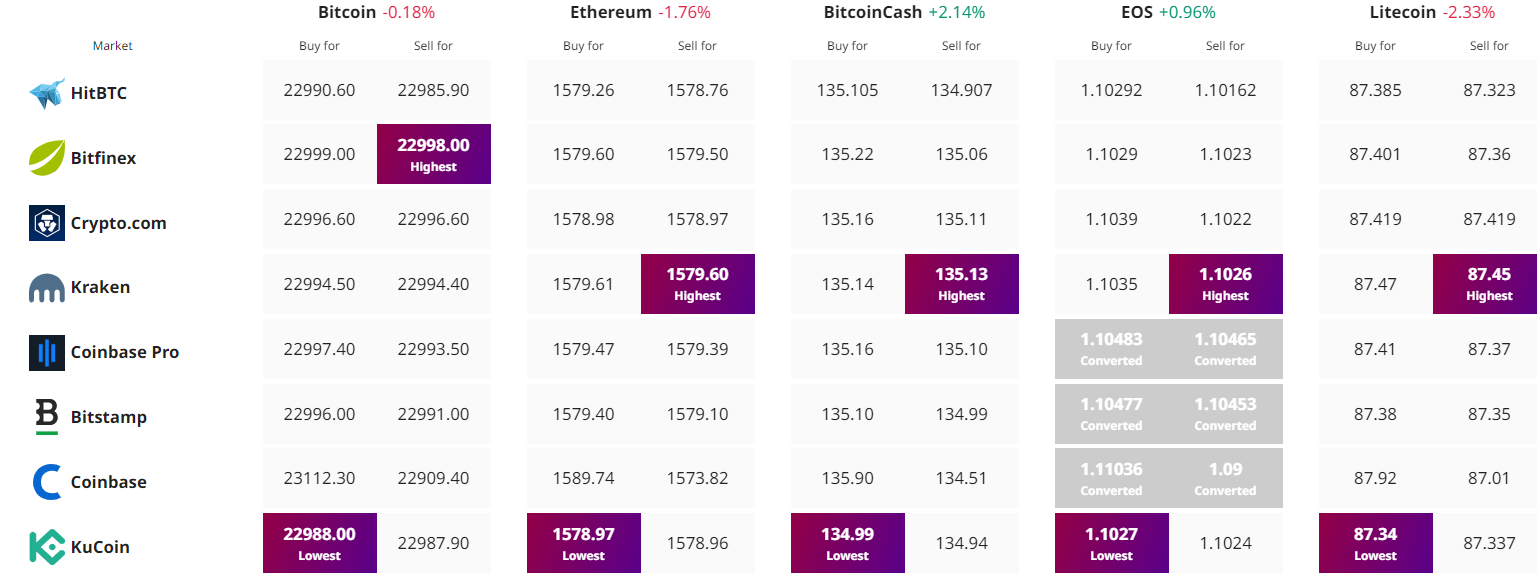

Find The Best Price to Buy/Sell Cryptocurrency